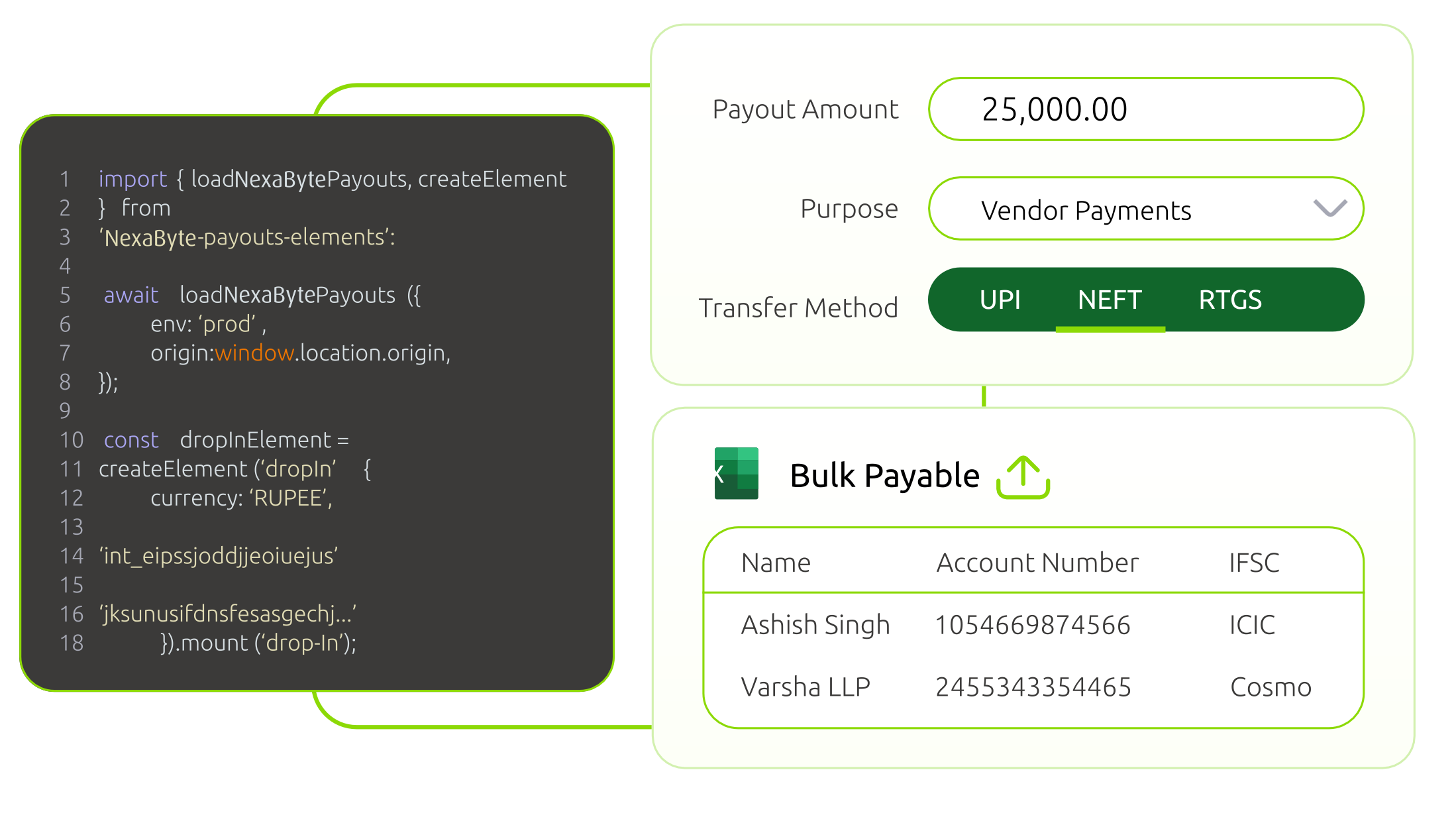

Seamlessly process payouts via UPI, NEFT, RTGS, or other preferred channels.

Execute multiple payouts simultaneously with real-time processing from dashboard or API.

Automated settlement, reconciliation, and reporting to save time and reduce manual effort.

Powerful security features including fraud detection, beneficiary verification, and multi-layered checks to minimize risk.

Detailed reporting and analytics to track payout performance and optimize transaction workflows.

NexaByte Payouts provides a trusted and scalable UPI-based platform. With quick onboarding, seamless API integration, exceptional success rates, and stability even during peak loads, it ensures your business never slows down.

Yes. If a merchant account is debited but the recipient doesn’t receive funds, NexaByte allows reversals to safeguard your transactions.

No. NexaByte Payouts enables bulk transfers without restrictions on the number of beneficiaries, making it ideal for scale-driven businesses.

To complete KYC, merchants need to provide:

- GST Registration Certificate

- Company PAN Card

- Memorandum of Association (MOA)

- Certificate of Incorporation

- Bank Account Details with IFSC Code

Once the primary merchant is onboarded and a MID is generated, they can onboard sub-merchants by verifying their KYC. NexaByte ensures smooth onboarding for extended merchant networks.

Yes, all payouts are routed via a current account with our Sponsor Bank (Cosmos Bank). Funds are debited directly before disbursement to beneficiaries.

You can reach us at sales@nexabyte.com or book a demo through the NexaByte website to get personalized guidance.